LICAT – An Evolution in Risk Assessment and Risk Management

01-Aug-2018

On January 1, 2018, a new solvency regime – the Life Insurance Capital Adequacy Test or LICAT – went into effect for all Canadian life insurance companies. This includes Brookfield Annuity Company, as we are a life insurance company with a focus on pension de-risking solutions like group annuities and longevity insurance. LICAT replaced the Minimum Continuing Capital and Surplus Requirements (MCCSR) assessment tool, which had been the basis for establishing the Canadian life insurance industry’s required capital underpinning since 1992.

The Office of the Superintendent of Financial Institutions (OSFI) created the new solvency regime to better align capital requirements with the credit, insurance, market and operational risks faced by the industry and to address issues that arose during the 2008 global financial crisis. LICAT also incorporates recent advances in economic and financial practice, evolving actuarial and financial reporting standards, and developments in global solvency frameworks.

Simply stated: LICAT is a more evolved and more risk-based approach to ensuring a life insurance company can meet and manage risks and fulfill its obligations to policyholders.

The Pension Promise … Plus

Before further discussing the impact of LICAT, let’s consider some basic differences in the way pension plans and insurance companies are regulated. Like insurance companies, Canadian pension plans are also subject to strict oversight; however, they may only need to file valuations every three years in some instances – and never more frequently than annually. These valuations assess whether the plan has sufficient assets to cover its liabilities; where it does not, a contribution or top-up schedule is established to restore the plan to being fully funded over a number of years.

A group annuity is another way of keeping the pension promise. And life insurance companies, which pay such annuities, are mandated to be considerably more financially secure than the typical defined benefit pension plan offering. All life insurance companies must file a valuation with OSFI every three months to prove that they have capital and reserves well in excess of their obligations. In fact, under LICAT, the amount of capital that insurance companies have to hold is calibrated to be enough to withstand losses so severe that they are only expected to occur once in every 200 years.

If you were wondering how the obligations of insurance companies are funded compared to pension plans, click here: The Annuity Edge

From safe and strong to safer and stronger

The adoption of LICAT enhances an already robust capital regime and helps to reinforce Brookfield Annuity’s founding premise: that for more and more defined benefit plan sponsors, an annuity is the most secure way to keep the pension promise. To support that point, let’s get into a bit more detail about what LICAT is and how it will affect our day-to-day activities.

The LICAT regime measures an insurance company’s available capital relative to its required capital. The ratio of available capital resources to required capital is known as the LICAT ratio and must always be at least 100%. OSFI has also strengthened the framework by tightening up what can be considered eligible capital under LICAT.

Comparing a Canadian life insurance company’s former MCCSR ratio to its new LICAT ratio is a bit like converting from Fahrenheit to Celsius: the measures are completely different, with the new ratio now being about half of the old one, except in the extremes. Insurance companies with MCCSR ratios of 240% now have LICAT ratios in the range of 130%. In moving to this new “metric” system, OSFI has also lowered the Supervisory Target solvency ratio above which it expects all insurers to operate: from 150% to 100%.

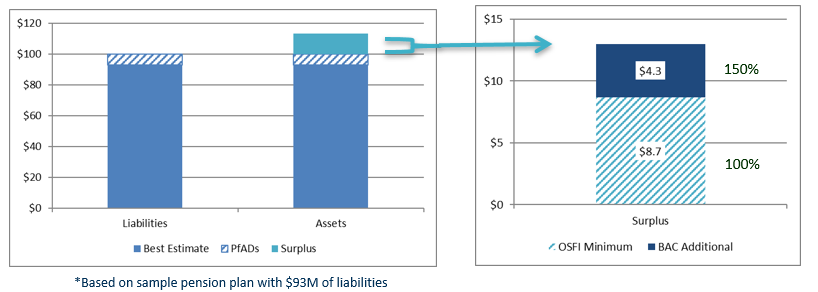

In addition to holding enough capital to absorb unexpected losses, insurance companies also establish and maintain margins over and above the best estimate of their liabilities. These additional amounts are known as provisions for adverse deviations, or “PfADs”. At Brookfield Annuity, as the chart below shows, we hold reserves and capital amounting to at least 120% of our best-estimate annuity obligations.

One CAT good. Two CATs better

In addition to meeting the LICAT standard, Brookfield Annuity also has to comply with Dynamic Capital Adequacy Testing (DCAT), an annual stress test mandated for life insurance companies under the Insurance Companies Act. Conducted according to the standards of practice of the Canadian Institute of Actuaries, this exercise consists of demonstrating over a five-year projection period how a company would fare in the face of several very trying, but completely plausible, financial and business scenarios.

Designed to be difficult, these scenarios are intended to identify realistic threats to an insurer’s financial condition, which, in turn, makes it possible to identify actions that would lessen the likelihood of the threat or mitigate its impact. OSFI receives a copy of an insurer’s DCAT report each year along with detailed plans for making sure that the company’s financial condition remains satisfactory over the projection period.

LICAT and DCAT share a common objective in ensuring that Canadian life insurance companies are well capitalized and well able to withstand a multitude of challenges, both likely and unlikely, that could occur tomorrow, next year, many years from now … or never. (The last is our preferred option.) Still, whatever the future holds, at Brookfield Annuity we believe the strength of our LICAT ratio reflects our commitment and our capacity to keep the pension promise.

By

Mark Austin

Chief Risk Officer

Brookfield Annuity Company