Understanding Your Pension Plan's Longevity Risk

15-Nov-2016

Across Canada, people are living longer. This increased longevity, while an unquestionably positive development, can also have a significant impact on pension plans.

Simply stated, longevity risk is the risk posed by living longer than expected. For individuals, this can mean the risk of outliving your savings. For a defined benefit (DB) pension plan, the plan sponsor is exposed to the risk of funding more pensioner payments than expected. For a typical DB plan, each year of increased life expectancy increases pensioner liabilities by roughly 3% to 5%.

Longevity risk is non-diversifiable

Many investment risks can be reduced, at no additional cost, through pooling and diversification, but not longevity risk: it is non-diversifiable. Because longevity risk cannot be diversified away by increasing the size of the group, even the largest pension plans are still exposed to longevity risk.

Canadian life expectancies have been steadily increasing

From 1966 to 2016, Canadian life expectancy at age 65 has increased by 6.3 years for males and 5.6 years for females.[1] This corresponds roughly to an 18% to 30% increase in pensioner liabilities.

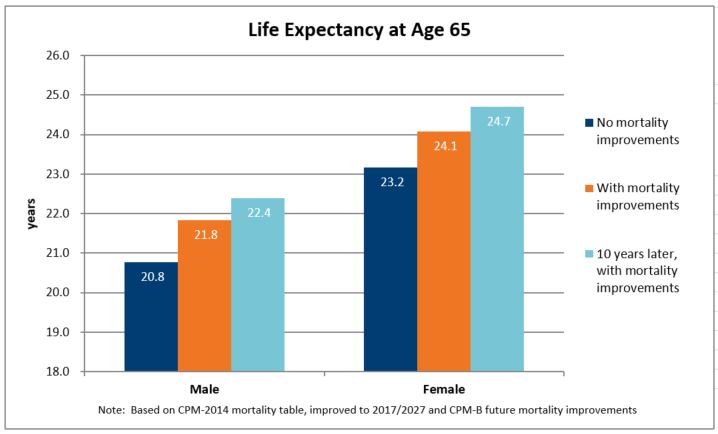

Thanks to improved nutrition, ongoing medical advancements and the continuing decline in the number of smokers, most experts believe life expectancies will continue to rise. By incorporating future mortality improvements as predicted by the industry standard scale (i.e., CPM-B), life expectancy at age 65 is expected to increase by another year. Life expectancy is expected to be even higher for individuals retiring in the future. For example, by 2027, at age 65 the average male can expect to live for another 22.4 years and the average female for another 24.7 years.

Assessing your plan’s longevity risk

At Brookfield Annuity, we strive to understand the underlying factors that impact pensioners’ life expectancies today and in the future.

While average life expectancies have increased steadily, the rate of increase for the members of any particular pension plan varies according to many factors, including age, gender, job type, spousal status, pension income, lifestyle and health. Some of these factors are easier for plan sponsors to determine than others.

For instance, plan sponsors will not be aware of the health of their members, or of their income from all sources (e.g., spousal pension, investment income, etc.). It is possible, nevertheless, to estimate the impact of these factors on life expectancy by examining observable variables such as salary at retirement, postal code and pension type selected.

It is vital that all plan sponsors do their best to fully understand their plan’s specific longevity risk, as well as the economic impact of this risk under various stress scenarios. Brookfield Annuity offers various solutions, including group annuity buy-in/buy-out and longevity insurance, which can help plan sponsors transfer their plan’s longevity risk.

[1] Actuarial report 27th on the Canada Pension Plan as at 31 December 2015, 22 September 2016, pg. 84.